Freight Factoring as Full-Service Outsourcing

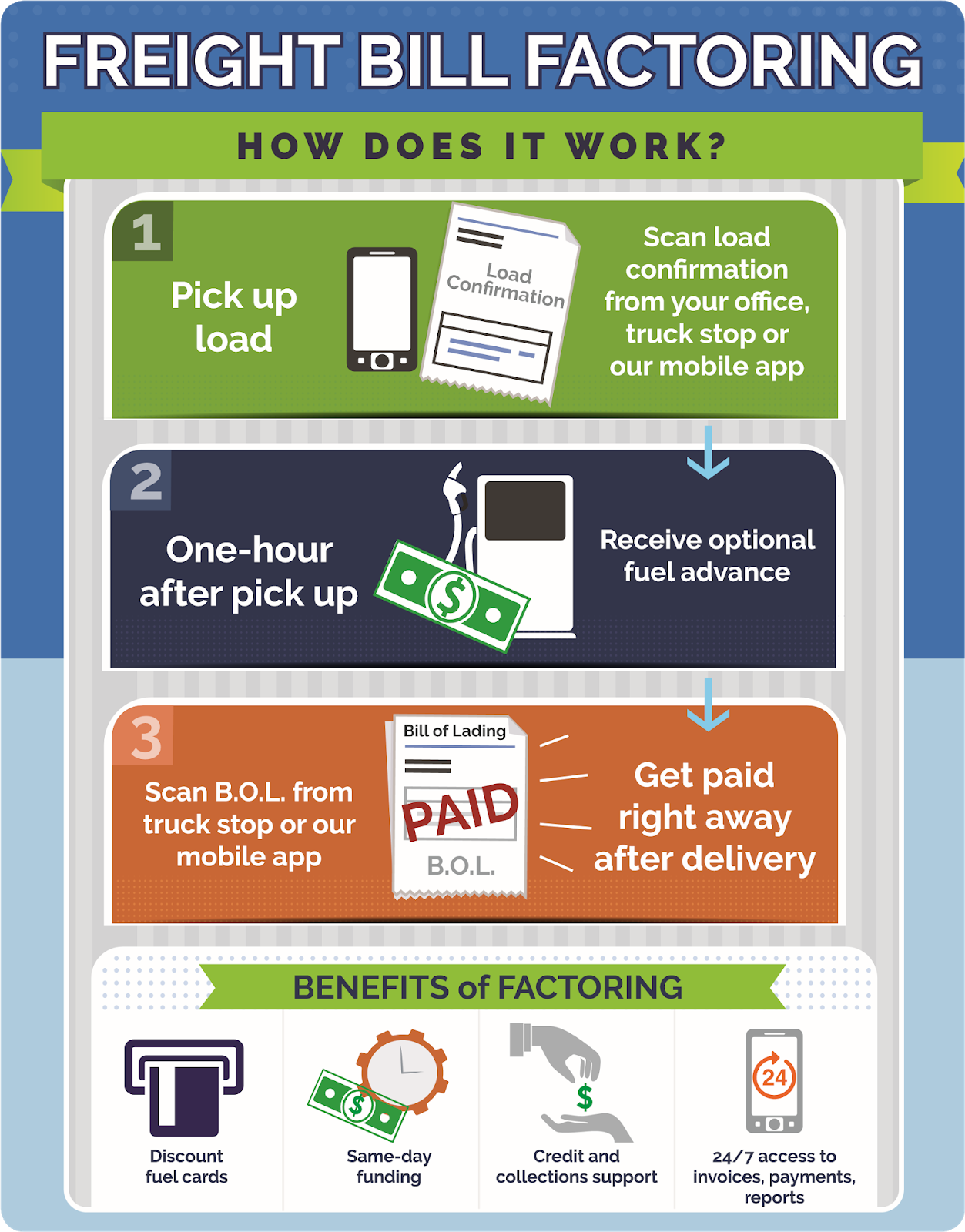

We’ve talked about it plenty of times before: Freight factoring. Still, not enough fleets are taking advantage of this underutilized resource. Let’s have a quick primer on what factoring is. Traditionally, a shipper makes a shipment or delivery and sends an invoice to the fleet. The shipper has the option to pay for the goods … Read moreFreight Factoring as Full-Service Outsourcing