We’ve talked about it plenty of times before: Freight factoring. Still, not enough fleets are taking advantage of this underutilized resource. Let’s have a quick primer on what factoring is. Traditionally, a shipper makes a shipment or delivery and sends an invoice to the fleet. The shipper has the option to pay for the goods by the due date on the invoice, or, in many cases, to pay the invoice earlier at a discount.

That is how it is normally done. In a freight factoring situation, the transaction is different. Under a conventional factoring agreement, the trucking company makes the delivery and then sells the invoice or accounts receivable to a third-party operator. These entities are usually banks or other financial institutions.

The trucking company then receives a discounted portion of cash in advance of actual payment of the goods from the buyer. The freight factoring provider receives a fee, often retaining a discounted portion of the gross invoice once it is paid. The fee to the factor covers its cost of processing invoices and collecting payments, as well as its lending cost of funds.

Factoring provides a great way for fleets to avoid finding themselves in a cash crunch. Often, a shipper may take an inordinate amount of time to pay the invoice. For smaller trucking companies this can be especially problematic. When the bills are due, you simply can’t wait for a buyer to come through. This is where factoring comes in. Yet, there are key differences between freight factoring and other forms of financing utilized by trucking companies.

Freight Factoring or Supply Chain Finance?

Another form of financing is that of supply chain finance (SCF). In supply chain finance, the factoring is a shipper-controlled early-pay finance program. In conventional factoring, the relationship is on the trucking company and the financial institution. When utilizing SCF, the relationship is on the shipper and the financial institution.

In these cases, the shipper establishes the relationship with a financial institution or funds the initiative themselves. They will also get a discount for paying invoices early. The shipper then invites the trucking company to join the program.

In this scenario, the fleet will receive the full amount of the invoice less the fee. It is also up to the motor carrier to decide what invoice they choose to sell or trade. Another critical difference is that conventional factoring agreements often require that a trucking company provide an entire portfolio of accounts or be subject to invoice volume requirements.

A majority of large-box retailers use SPF with their suppliers and vendors. It provides a level of security and uniformity that you cannot get through other financing methods. Smaller trucking companies utilize this financing method less.

Freight Factoring Fuels Growth

While it is clearly documented that freight factoring has helped many fleets get on their feet, new data shows it also helps fleets grow. The main reason? Factoring companies have been evolving their portfolio of services over time. In fact, data from recent years indicates that factoring fleets grow faster than others, or that the average size of fleets choosing to factor has increased, if not both. But why?

There is definitely more than one reason. The first, and most paramount during the COVID crisis, is that slow business cycles make it difficult to grow and meet financial obligations. A brand-new fleet with a small number of reliable customers who pay their bills on time may not need to utilize factoring as a source of financing.

But consider what happens as that fleet grows. Suddenly, here are a lot more shippers on the horizon. As that fleet grows, it is highly likely they will see more delinquent accounts pop in. The question is, how fast can they keep growing when they are trying to track down missing payments? According to the data, not very.

In a 2016 study completed by RigDig Business Intelligence on fleets with fewer than 10 trucks, they found there was no difference in the average size of fleets that factored and those that didn’t. Since then, the average size of fleets that factored at least some of their invoices on average grew by 90%, while the size of non-factoring fleets grew by just 30%.

It is not hard to see that freight factoring was a contributor to those fleets’ higher levels of growth. While it can be said that the growth itself prompted the need for factoring, it is highly doubtful that the growth would have accelerated or stayed steady had the trucking company not embraced factoring as an option.

There is plenty of data to show that companies who outsource non-critical aspects of their operation increase their own levels of operational efficiency. And there is a good reason why. Taking unnecessary duties off the hands of small trucking companies is bound to facilitate their ability to focus on other things. These things could include developing customers, caring for equipment, or investing in processes that improve operational efficiency.

More Than Just Factoring

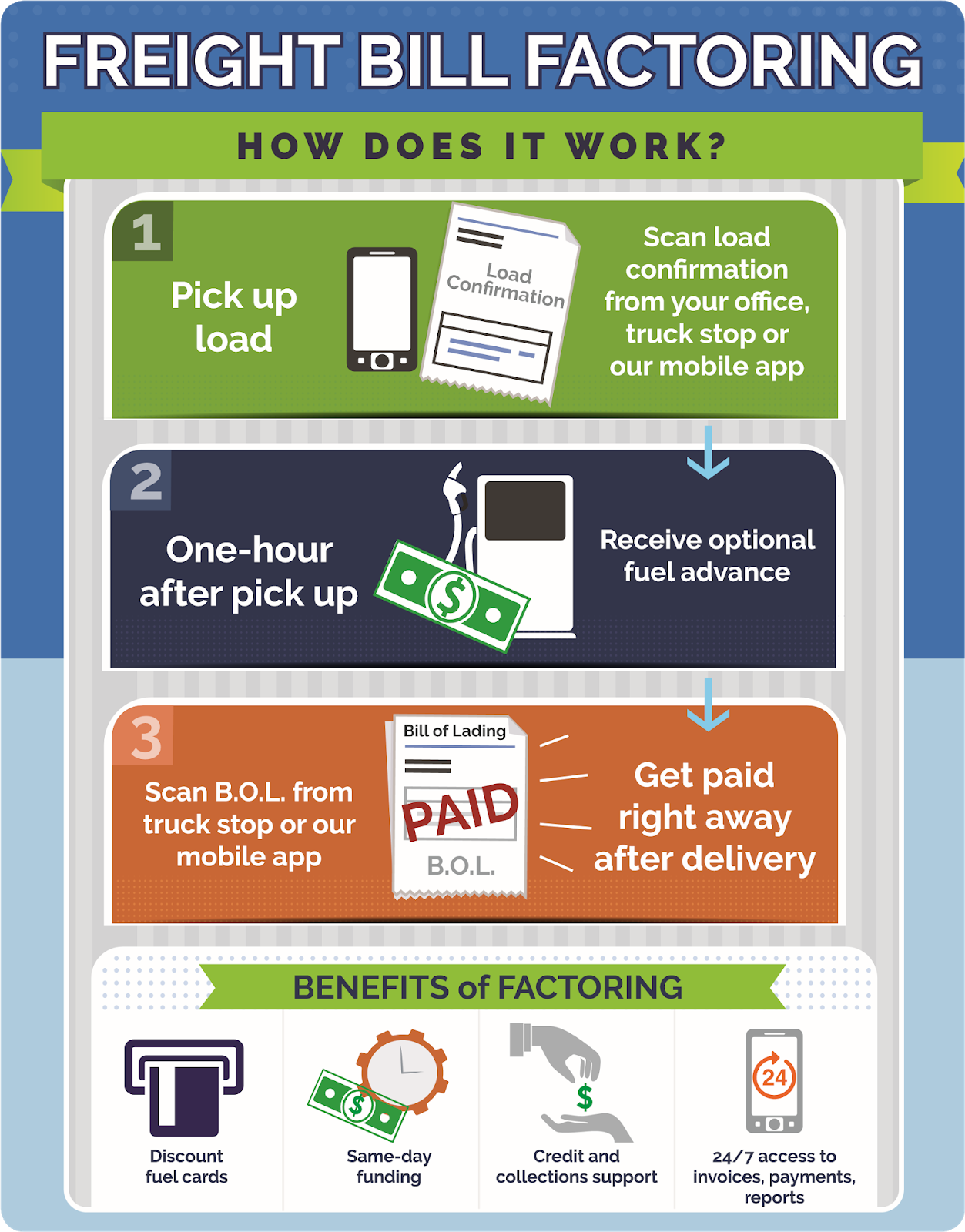

Factoring has changed. No longer are these companies just financing invoices. They offer many more services now. There are many ways the most well-known freight factoring provider have found to help clients survive the growing pains of starting a new trucking company and, by extension, retain some of them over time.

These offerings could include discount buying programs and some factoring companies’ integrations with major load boards and affiliated traditional equipment-financing arms. These companies have turned into full-fledged back-office outsourcer.

One example is of a factoring provider who provides an equipment-finance shop. They also provide simple programs to assist in insurance down payments that work like an advance on future factored invoices. They also purchase future invoices at a low rate, providing a kind of credit line to the trucking company.

Services like these are more important than ever during COVID-19. During the height of the pandemic, many trucking companies faced prevalent undercutting in the markets. Those that took advantage of factoring finance instruments had extra cash on hand.

Other factoring companies offer fuel cards and advances on fuel costs. Some have also gotten into the businesses of creating or providing transportation management software and other freight resources.

Nowadays, trucking companies can have easy submission of invoices for payment through simple web-based dashboards. In the age of the ELD, paperless solutions like these are exactly what fleets need.

A Big Bank Steps In

More recently, U.S. Bank has rolled out a new tool that is designed offer another way to factor. The innovation U.S. Bank has introduced allows fleets to choose which invoices get paid early and which ones don’t. They call it the Cash Manager system.

Through an online dashboard, motor carriers can do is choose an invoice and accelerate it for payment. Fleets can then take a holistic view of their entire invoice portfolio and decide which ones may be better candidates for factoring. Previously, motor carriers getting paid by their shippers through US Bank had the ability to have all payments from a shipper accelerated — or none of them. Having more choice offers greater flexibility.

Consider some fleets that avoided factoring because they considered it paying to get paid. In the new system, the same fleet might decide that a particular shipper is being problematic. In that situation they can choose to factor that one invoice only. While many see this as a direct challenge to other factoring providers, it will likely fill a niche for those fleets who want more flexibility.

No matter what U.S. Bank does, freight factoring providers are here to stay. Consider that the total global factoring market is represented by more than 7,000 very large, well-capitalized global banks, middle market domestic banks and lending institutions, as well as online factoring and technology companies. The total global market is expected to reach nearly $10 trillion by 2025.

Freight factoring is designed as a solution to help trucking companies keep their balance sheets in line. And with the array of new services being rolled out by freight factoring providers, fleets have no excuse not to take advantage. Most successful factoring relationships between trucking company and their provider are those in which the trucking company runs a successful business with a stable balance sheet, sells a product that is in high demand, and possesses a financially healthy customer base. Is that your fleet?